I don’t normally post news articles here, but I feel so strongly about this topic. Jobs matter. One of the great satisfactions of my career is creating them. And I was proud to stand up for Omaha jobs when we merged TD Ameritrade with another organization.

By Henry J. Cordes / World-Herald staff writer

Nov 30, 2019

Omaha World-Herald Article

I don’t normally post news articles on my blog but this one was important to me so I wanted to highlight it here:

Charles Schwab and TD Ameritrade were set to publicly roll out a blockbuster brokerage merger that would shake up the investment industry, send both companies’ stocks soaring and fan deep fears of job loss in TD Ameritrade’s home city of Omaha.

Then just hours before the planned announcement, timed to hit just before markets opened Thursday, Nov. 21, Schwab officials noticed something concerning: The sale of TD Ameritrade had not been signed off on by the firm’s biggest individual shareholder, company founder Joe Ricketts.

The announcement was suddenly off. And when Schwab reached out to Ricketts later that morning, his representatives communicated a condition Ricketts wanted if he was going to sign off on voting his shares for the merger. The deal would have to include language offering some protection for TD Ameritrade jobs in Omaha.

In the end, Ricketts reportedly was satisfied with what he got — a signed agreement intended to provide a measure of security for TD Ameritrade’s Omaha workers.

On its face, the wording in the agreement Schwab filed with federal regulators last week provides no guarantee that all — or even any — of the 2,300 TD Ameritrade jobs will remain in Omaha for the long term. The language gives Schwab much leeway to reduce the acquired firm’s workforce in the city, and the agreement sunsets after two years.

But an expert on mergers law says the words could still pack both legal and practical punch. And a person close to the transaction says Ricketts was satisfied the agreement will accomplish his goal: requiring Schwab to be deliberate in the coming years as it considers how to integrate TD Ameritrade’s Omaha operations into its own.

“It’s not a rock solid ‘no one can get fired,’ but it’s a commitment by Schwab to be reasonable and thoughtful in how they approach this, and the fact Schwab agreed means they are taking it seriously,” said the source, who had knowledge of the agreement and spoke on condition of anonymity. “It’s a merger. Changes are going to happen. But they’re going to happen in a thoughtful way.”

A spokesperson for Schwab declined Friday to comment or answer questions about the agreement or how it came about. Joe Ricketts through a spokesman also declined to comment.

However, Nebraska Gov. Pete Ricketts, his son, said the agreement “reflects a commitment to maintain a level of jobs in Nebraska” and “gives us the opportunity to make the case to Schwab to grow here in the future.”

Pete Ricketts, a former TD Ameritrade executive who as governor is the state’s de facto chief economic development officer, said he has since Monday spoken to Schwab chairman and founder Charles “Chuck” Schwab and company CEO Walter Bettinger.

“I will continue to make the case in the coming months,” Ricketts said.

The jobs agreement, signed by Bettinger, Joe Ricketts and his wife, Marlene, was part of a pile of merger-related legal documents Schwab filed with the U.S. Securities and Exchange Commission Wednesday. Here is how the relevant language reads (“Parent” being Schwab and “Company” being TD Ameritrade):

Post-Closing Integration. Parent commits in good faith to seek to maintain, from the Closing Date through the second anniversary of the Closing Date, a level of employment in Nebraska comparable to the Company’s level of employment in Nebraska at the Closing Date, taking into account voluntary attrition and transaction-related integration plans.

Irina Fox, a mergers and acquisitions expert with Creighton University’s law school, agreed that the latter part of that wording does give Schwab much freedom to reduce Omaha employment. But she said no one should overlook the significance of Schwab’s commitment to “in good faith” seek to maintain Omaha employment — words that also carry significant legal meaning.

“That does put a little restriction on their discretion,” she said. “If they were to fire a significant percentage of the Omaha employees, they would need to do quite a bit to justify that decision. There is a good faith clause there where they promise not to do it arbitrarily. I think this clause has some teeth.”

Legalities aside, it’s probably not a bad thing for Omaha’s future job prospects that Schwab’s leadership made a promise to TD Ameritrade’s founder. All things being equal, it’s certainly not unheard of for boardroom politics to play a role as companies make decisions on where jobs will be located.

And that may be particularly noteworthy in this case, in which the two company founders have a long shared history.

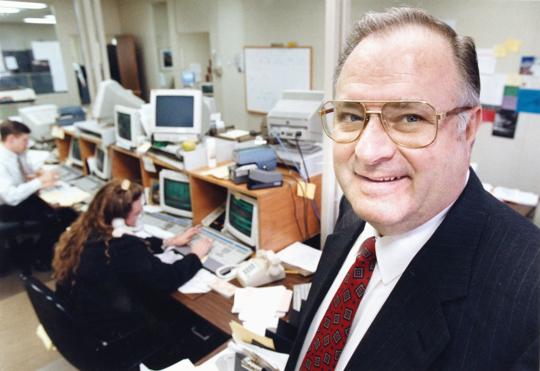

KILEY CRUSE/THE WORLD-HERALD

As it happens, within a single month this fall, both Chuck Schwab and Joe Ricketts came out with autobiographies telling their own life stories. And in back jacket quotes, each man actually offered praise for the other.

Schwab lauded the guts, tenacity and creativity of his Omaha-based competitor. Ricketts described Schwab as a man of high integrity and a fierce rival who he now considers a friend.

Indeed, the two men have much in common.

In 1975, Ricketts and Schwab founded two of the nation’s very first discount brokerages, their low trade commissions helping to democratize stock trading, bring investing to the masses and shake up the Wall Street establishment.

While Schwab’s San Francisco-based firm largely evolved into a traditional wealth management company offering financial advice to individual investors, Ricketts’ firm in Omaha was more of a technological innovator. One of his first breakthroughs was a niche technology he developed that allowed customers to make automatic trades on their touch-tone phones.

That platform left Ricketts’ firm well-positioned in the 1990s when the Internet and home computers rose to prominence. In 1995, Ricketts’ firm bought the company that had just pioneered the first online trade, and he dove headlong into the fast-growing, lucrative new business line.

The sales commissions starting rolling in, and TD Ameritrade shot off like a rocket. By 1997, Ricketts took his family business public. By 1999, Joe Ricketts was a billionaire.

The company continued to grow and thrive in Omaha, becoming the industry’s largest volume online brokerage with its widely recognized “eight bucks a trade” pitch. But technology and marketing aside, Ricketts spoke to a World-Herald reporter in 2006 about what he considered the secret of his firm’s success.

The key, he said, was the low-cost operations of TD Ameritrade’s back office trading center, at the time in the Southroads Mall in Bellevue. Staffed 24/7, it operated so efficiently and cost-effectively, no competitor could afford to offer online trades for less.

Ricketts also expressed an appreciation and affinity for his staff, talking of the pride he felt in helping create jobs that made a difference in the lives of his employees and their families.

“It had always been a point of pride with me that this business I had built was helping bring prosperity to some of my neighbors,” he wrote in his recent book. At times when he had to lay off workers due to stock market crashes, he’d do so, but said he’d “rather cut off my own arm.”

Once TD Ameritrade went public, the control the Ricketts family held over the firm loosened with time. Joe Ricketts retired as CEO in 2001, saying he was firing himself to put the company in more capable hands. He left the board of directors completely in 2011, though other members of the Ricketts family have continued to hold at least one board seat since that time.

Tapping its TD Ameritrade fortune, the Ricketts family in 2009 acquired the Chicago Cubs baseball team. Joe Ricketts became one of the largest funders of conservative politics and libertarian thought. He saw his son, the firm’s former chief operating officer, win the Nebraska Governor’s Office in 2014.

But over the years, Ricketts also continued to own huge amounts of TD Ameritrade stock, despite the persistent advice of financial advisers that he should do more to diversify. TD Ameritrade remained his baby.

To this day, he and his wife hold 8.6% of TD Ameritrade’s shares, and his children own sizable stakes as well. Before word of the Schwab merger leaked, Joe and Marlene Ricketts’ shares were worth almost $2 billion. Based on the premium they and other shareholders will receive from the sale, those shares are currently worth $2.5 billion.

Joe Ricketts rode his company’s stock through highs and lows over the years. He also watched as the firm gobbled up competitors and in 2013 moved into its new headquarters, a green-tinted tower meant to resemble a ticker tape that rises over Interstate 680 and West Dodge Road.

But in recent years came an industry challenge that finally proved the company’s match.

An upstart called Robinhood in 2014 began offering no-commission trading on a phone app, causing all the traditional players to start ratcheting down their commission rates.

On Oct. 1, Schwab announced it was eliminating all sales commissions on U.S. stocks and exchange-traded funds. Within hours, TD Ameritrade and other competitors were forced to match the move.

Schwab was completing the “race to zero,” and it appears to have been a strategic play, as it disproportionately hurt Schwab’s chief competitors.

For Schwab, the lost commissions reportedly amounted to less than 5% of revenue. For Ameritrade, the loss was 15%, nearly $1 billion a year. TD Ameritrade’s stock price plummeted by almost one-third.

At some point, Schwab and TD Ameritrade began merger talks. And when they got serious, TD Ameritrade officials provided Joe Ricketts and his family a “voting support agreement.” Such documents are common in business mergers and acquisitions, signed statements that bind major shareholder to vote stock in favor of the merger.

Such an agreement wasn’t needed for the deal to go forward. The considerable Ricketts family holdings were still just a fraction of TD Ameritrade’s shares.

And Ricketts actually fully backed the merger. According to the source close to the transaction, Ricketts believed that in a zero-commission world, having a company of significant scale would be critical to future success. Marrying TD Ameritrade with Schwab would provide that scale.

But Ricketts simply wasn’t interested in signing the voting support agreement. He just wanted to vote his stock the same way any other common shareholder would, later when TD Ameritrade schedules the shareholder vote.

While the reason is unclear, the fact Ricketts declined to sign the agreement apparently was not communicated by Ameritrade officials to Schwab until just hours before the planned Nov. 21 announcement.

Schwab’s leadership balked. They weren’t comfortable going forward without the Ricketts agreement.

It’s not exactly clear why Schwab officials hesitated. But it’s conceivable they were concerned that Ricketts owned enough stock he could cause difficulties for the merger if he suddenly decided the deal was a bad one and worked against it before the official shareholder vote.

Nebraskans in recent years have seen firsthand the power that can be wielded by a significant minority shareholder like Ricketts. Sidney-based outdoor outfitter Cabela’s was forced to merge with a competitor in 2016 after an activist investor owning 9% of its stock vocally objected to the firm’s financial performance and led a campaign for major change.

With the announcement suddenly off, the source said Schwab officials reached out to Ameritrade’s founder. Ricketts’ representatives explained that he simply didn’t want to sign the agreement. But they said he’d be willing to do so if Schwab made a commitment to preserve jobs in Omaha.

The memo details the $26 billion transaction and provides, it says, “answers to common questions.”

“Joe is a businessman,” said the source. “If you’re going to ask something from him, he’s going to ask something from you. The only thing he asked for was the jobs language.”

Ricketts was certainly realistic that the elimination of redundancy between the two companies will require job losses in Omaha. He wasn’t going to ask for blanket protection. But he still wanted to pursue language that would make Omaha jobs “top of mind” for Schwab — potentially easing the impact, the source said.

Schwab officials were “thoughtful and respectful” and took the request by Ricketts seriously, the source said. It was considered at the most senior levels of Schwab. It’s unclear to what degree Chuck Schwab himself, as Schwab’s chairman, participated in the considerations.

With some tweaking, the language was officially agreed to on Sunday, Nov. 24. The merger was announced the next morning.

Though it’s clear the language offers no guarantees, the source called it an important commitment from Schwab — one that bodes well for how that firm will approach Omaha jobs in the merger.

What the combined Schwab-TD Ameritrade ultimately looks like will be a long game that will play out over years. The deal is not expected to close until next year, with Schwab officials saying the full integration of the companies could take up to three years after that.

The Omaha agreement isn’t the only geographic consideration. With the merger, Schwab announced that the combined headquarters will be in the Dallas-Fort Worth metro area, where both TD Ameritrade and Schwab already have significant operations.

While Schwab declined to comment on the Ricketts agreement, TD Ameritrade officials acknowledged it, but said it’s premature to talk about how it will impact the firm’s more than 9,000 employees nationwide.

“Omaha has been, and we hope may continue to be, an important employment center for our company,” said spokesperson Kim Hillyer. “But it would be a disservice to our people — in Omaha and in other cities across the country — to speculate on what staffing in Omaha may ultimately look like.”

Fox, the Creighton professor, said the Ricketts agreement won’t keep Schwab from creating the efficiencies that shareholders expect when two firms merge. But she said the agreement could help shape where the combined operations end up. And the firm in many cases will have multiple cities to choose from, as both companies have operations spread around the country.

For example, about half of TD Ameritrade’s 2,300 Omaha workers are part of its clearing operations, making sure trades get posted to the proper accounts, at the right price and according to federal regulations. TD Ameritrade also has clearing operations in Dallas.

For its part, Schwab has clearing operations in both Dallas and Colorado. It would seem quite likely the merged company will continue to have clearing jobs in more than one location.

While Omaha is officially the home of TD Ameritrade’s corporate headquarters, company employees say the reality is most of its top executives have been based in New Jersey for the past decade. In effect, Omaha lost most of those jobs years ago.

Besides clearance, the balance of TD Ameritrade’s Omaha workforce is largely a mix of certified stockbrokers who handle trades by phone and information technology workers who operate the trading platform. There are such workers in other locations around the country, too.

George Morgan, a former stockbroker who teaches finance at the University of Nebraska at Omaha, said Omaha has lots of business advantages that should be appealing to Schwab. The city offers low operating costs, is home to one of the industry’s most user-friendly trading platforms, and has some of the nation’s best technology infrastructure, part of its legacy as the strategic home of the nation’s nuclear arsenal.

“From the perspective of Schwab, maintaining a presence in Omaha makes a lot of business sense,” he said.

But he said the Ricketts-Schwab agreement certainly won’t hurt matters, either. “I really commend Joe 100 percent for taking care of what he has built,” Morgan said.

Indeed, beyond the legal significance of the jobs agreement, Fox said there’s a practical effect, too. She doubts Schwab and its leaders would take a pledge they made to the founder of TD Ameritrade lightly.

“It is in the interest of Chuck Schwab to have Ricketts on board with the merger,” she said. “It is in everyone’s best interest to assure a smooth transition.”